DCO Case Study: Financial Services

A Fortune 100 Multinational Investment Bank Sees Growth In ROI With Jivox’s Enterprise-Ready Personalization

In Production Costs

over industry benchmark

Lift in CTR

over industry benchmarks

Increase in ROI

using Jivox

This American multinational investment bank was one of the first adopters of DCO automation in the banking industry and this bold step not only enabled it to scale its marketing campaigns but also improve ROI.

It began its DCO journey with us three years ago and with hyper-personalized communication has seen a positive shift in consumers’ perceptions.

The bank collaborated with Jivox’s Customer Success team to quickly build and run prospecting campaigns for a range of mutual funds for its wealth management division.

The end goal?

Increased awareness and interactions amongst investors.

Banking On The Right DCO Partner

This brand approached Jivox in search of a DCO partner with expertise in 3 key areas:

Security

in processing and analysing large volumes of data while being compliant with SOC2 Type 2 standards

Legal Compliance

with obtaining creative approvals and feedback across all variations in a time-efficient, secure and streamlined manner

Enterprise Access Management

to help replicate the complex hierarchies of users, partners and permissions involved in marketing workflows

Successful Investments in Automation

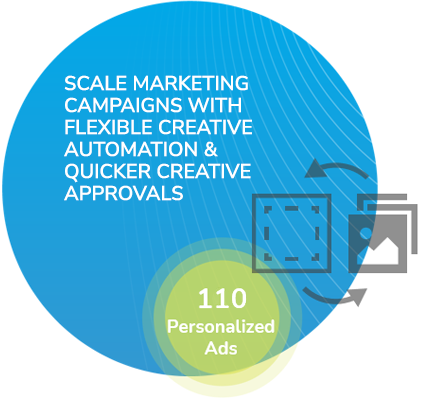

The brand was seeking a true enterprise grade personalized DCO experience that would enable it to automate and scale its slow and expensive creative production process.

Building Bonds With Investors Via Engaging Automated Creative

The brand used our Dynamic Canvas Studio to:

- Replace standard, templated creatives with visually-appealing, on-brand ads

- Automate the generation of close to 110 personalized variations from a handful of creative masters

- Ensure consistency in messages across multiple channels in a cost-effective and timely manner

Optimizing Investments, Automated

Jivox’s powerful auto-optimization feature enabled this brand to:

- Personalize ads with messaging based on the location and segment of the viewer to increase engagement and conversions

- Clock in a CTR jump (over the benchmark figures) of 35x versus the benchmark for its campaigns

- Perform A/B tests on creatives to serve the most relevant ads to the right audience across the right channels

CHANNELS

DYNAMIC ELEMENTS

DATA TRIGGERS