In Part 1, we discussed the history of e-commerce and the emerging trends in commerce in North America. North America post COVID has seen a sharp acceleration towards adopting more e-commerce with large retail chains migrating much of their infrastructure to the cloud and their customer acquisition efforts online. In particular, five major trends were discussed:

- Higher E-Commerce Marketing

- Higher Levels of Automation

- Higher ROAS Attribution

- Integrated Omnichannel CX

- Self Service Platforms

In this part, we discuss the emerging trends in the EMEA region. With large CPG and omnichannel brands, many of the existing trends that we’ve seen in the US are very similar to the ones in EMEA. However, EMEA, due to a more international context, varied shipping infrastructure, privacy regulations, tax implications and varying country expectations, has a different approach to many of the existing digital trends. In this article, we take a deeper dive into the trends that retailers and brands should be aware of to accelerate growth during COVID digital transformation.

A Brief History of EMEA Commerce

Since 2018, the growth in e-commerce has been growing consistently with the Europe top 500 median growth of 15% being primarily driven via e-commerce.

In fact, much of digital commerce growth came from mass merchants using an integrated omnichannel approach. The leading categories in order of ranking include: (1) Housewares (2) Food and Beverage (3) Apparel (4) Consumer Electronics and (5) Health and Beauty.

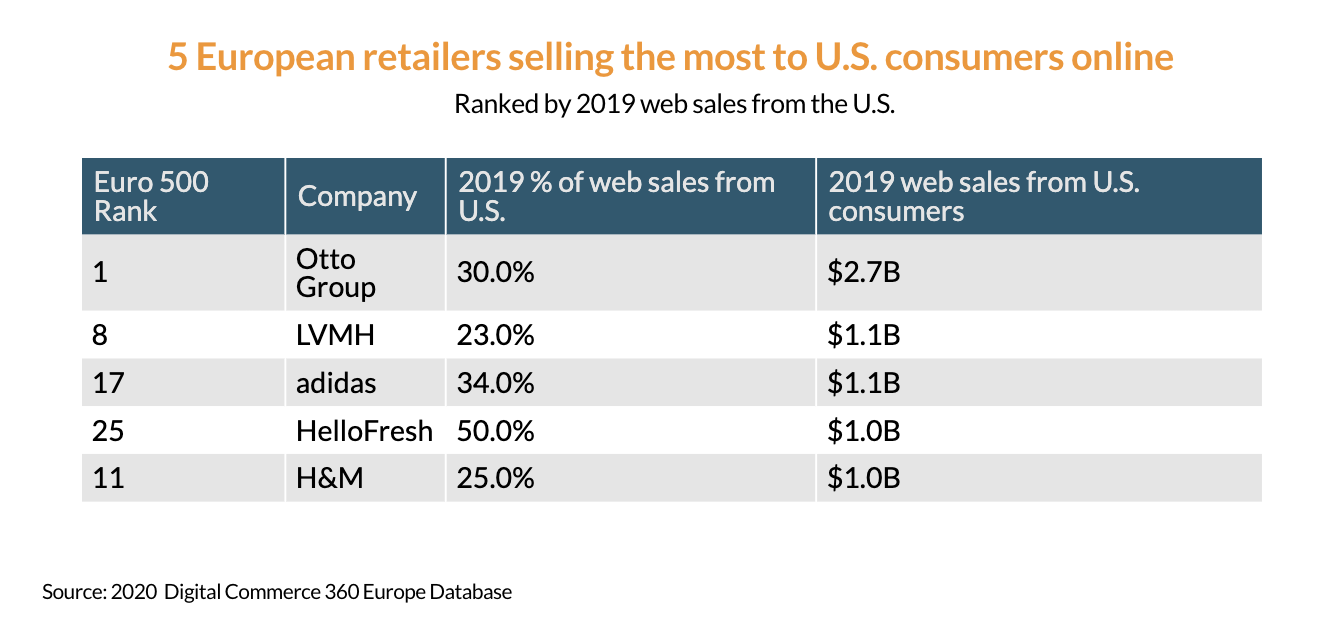

European exports have also seen a surge in North American consumption via overseas shipping and international warehousing.

European Trends

With the surge in digital media spend and direct to consumer (DTC) transformation post COVID, the average median online conversion rose to 2.1% while retail job cuts rose with brands like Burberry cutting nearly 5% of their workforce in spite of support from stimulus programs, In fact, e-commerce is valued at approximately 717 Billion Euros in 2020 from over 800,000 online stores with 24% of the e-commerce being cross-border, according to E-Commerce News EU.

The trends fueling the e-commerce consumption in Europe include:

- Fast and Flexible Delivery: As opposed to North America, Europe is less price sensitive and willing to pay more for quicker delivery of goods that matches the convenience of their lifestyle. While free delivery is obviously preferred, MetaPack’s 2018 State of E-Commerce Delivery Consumer Research Report highlighted that 61% of respondents chose a positive delivery experience as the incentive to shop with the same etailer again.

- Pick Up Drop Off (PUDO): Delivery to a pick-up point or local shop holds a strong appeal for European shoppers who often use this service—particularly in France (58%), Spain (50%) and the Netherlands (46%), according to MetaPack’s research findings. In Scandinavia, PUDO is considered the number one delivery preference. Similarly, when it comes to returning items, 37% of Europeans drop off goods at a PUDO point, higher than 28% of U.S. consumers.

- Integrated Fulfilment Strategy: When building a supply chain strategy in Europe, there are four stages for the typical evolution of fulfillment for retailers and brands. These include:

- Ship from the U.S.

- Single Third-Party Logistics in Europe

- Multiple Third-Party Logistics in Europe

- Own Warehouse in Europe. Merchants will have to identify which stage they are currently in and the appropriateness of remaining in that stage or advancing to the next based on the volume of goods and customer expectations.

- Multi-Carrier Strategy: According to MetaPack research, two-thirds of European retailers use between two and ten carriers. Half have about five carriers for domestic and international needs. Large integrators, such as FedEx and UPS, serve the cross-border market but can be more costly. Commercial carriers are often offshoots of the larger postal operators, such as GLS, part of Royal Mail Group. Niche carriers provide custom logistics services—for example, Addison Lee in the UK provides a same-day courier service.

Detailed trends in Europe can be found in the EU E-Commerce Survey Report of 2020.

Middle East and Africa (MEA) Trends

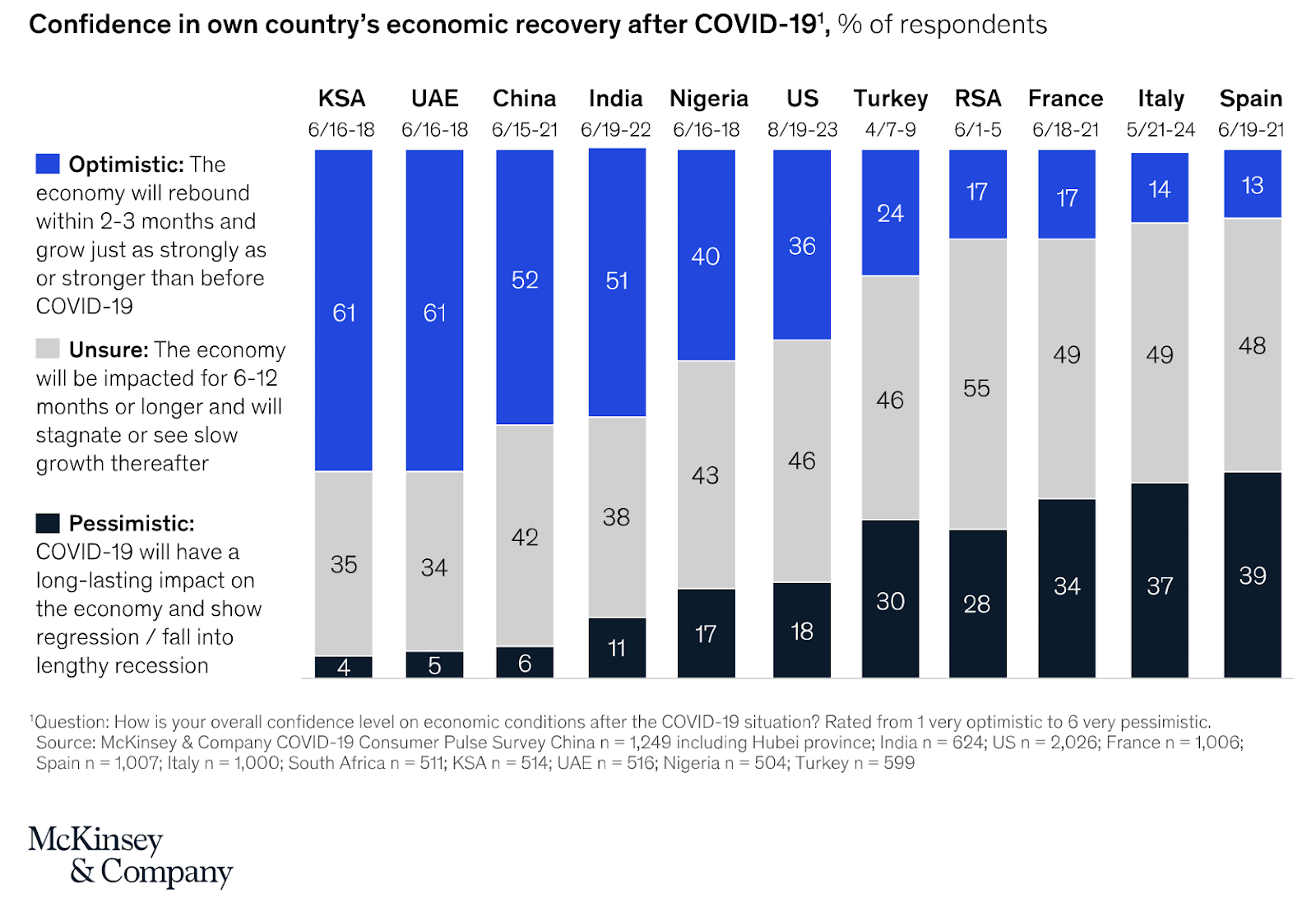

According to Bain and Company, e-commerce in the MEA region has entered the third phase of digital adoption. Growth rate reached 30% in 2017 with Amazon rebranding 2017 acquired Souq in 2019 and doubling down on the massive consumer economy. In more recent days with COVID, the region has displayed a tremendous amount of optimism in the face of the global pandemic. Doubling down on the state of the global economy and work from home trends, the region has increased its propensity to spend online. According to McKinsey, Saudi Arabia and the UAE are ahead of several top global economies for the same reason.

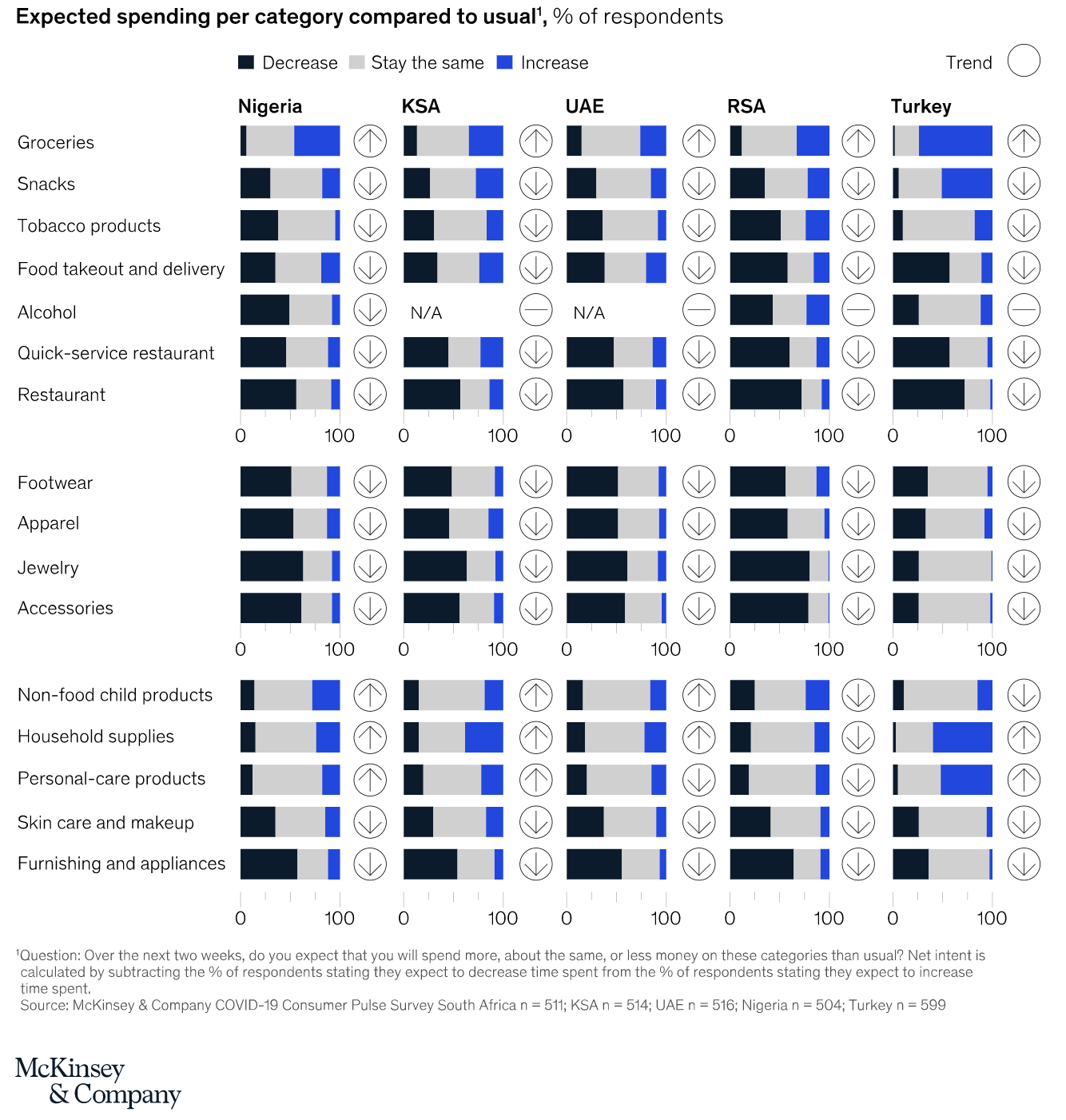

Categorical trends in the region in countries like Nigeria, Saudi Arabia, the UAE, South Africa and Turkey show increased spending on Groceries, Houseware, Childcare and Personal Care post the beginning of the pandemic.

For e-commerce players in the region, the Middle East is very much still in the digital mass merchant era with marketplaces and aggregators like Souq, Dubizzle, Jumia and Konga leading the charge. The Middle East continues to consume American and European DTC brands with cash on delivery being the preferred mode of payment. For local players like Spinneys in the region, taking a mass merchant approach and continuing operations with carriers like Aramex will yield the highest returns in the immediate future.

Africa, on the other hand, is in Phase 1 of building its own digitally native DTC brands. With venture funding having skyrocketed in the region and talented entrepreneurs building solutions that can service their local economies / regions, several interesting companies are changing local consumer behavior. Interesting ones include:

- Taeillo, a Nigerian furniture and lifestyle brand leverages immersive tech like Augmented Reality, Virtual Reality and Mixed Reality, allowing customers to visualize & customize furniture products in their personal spaces before getting them to their doorsteps.

- In South Africa, Cellardirect, allows customers to buy wine online directly from wineries to their doorsteps. The prices of the wines sold by the brand are the same with standard winery prices proving the DTC model isn’t just appropriate for fashion and beauty products.

- Drowzy, a Cairo-based DTC furniture and home accessories company offers faster delivery times than its competitors for its 100 products.

To learn more evolving trends in the digital media landscape and how global companies are using Jivox to integrate more DTC approaches and personalize omnichannel customer experiences for higher ROI, please visit Jivox at www.jivox.com or subscribe to our Linkedin Page.