Growth Commerce represents a navigated tour around the world with regards to emerging e-commerce trends and patterns. With globalization accelerating the bridging of networks, cloud becoming the de facto standard of technology architectures, security in payment layers and simplification in omnichannel operations, e-commerce is here to stay. In this part 1 of the series, we will take a deeper dive into the emerging trends in the Americas, emerging players and new methodologies for global commerce within and across borders.

A brief history lesson: Brick and mortar has historically been the primary driver of consumer transactions with new POS and in-store footfall management technologies being the primary source of commerce. Amazon and Ebay historically allowed the sale of goods to be sold via marketplace platforms as an additional channel. Merchants saw huge traffic and conversion, which led to the prioritization of selling via other third-party platforms like Etsy.

Brands recognized the trend and the need to accelerate digital transformation via platforms like Shopify, BigCommerce and Magento. These players became the e-commerce stack for players to prospect, retarget and convert customers across platforms. Programmatic advertising and email marketing were the primary drivers for B2B players to recognize higher average revenue per user (ARPU) and return on ad spend (ROAS). Soon, social was the next medium, with Facebook Collaborative Ads becoming the way for consumers to intelligently navigate product categories, discover and purchase. As networks grew, Instagram, Pinterest and WhatsApp became new media to purchase, with each platform having specific frameworks and tooling for growth to attract and retain customers.

Source: Martech Cube

In the current era, customers are looking to bridge the gap of their current social, display and / or email footprints with offline experiences. Brands can leverage omnichannel analytics to recognize opportunities and upsell products. This, with dynamic creative optimization (DCO), customer satisfaction (CSAT) measurement and e-commerce integrations, represent the complete experience to monetize the funnel of customer activity with maximum efficiency.

Source: Martech Cube

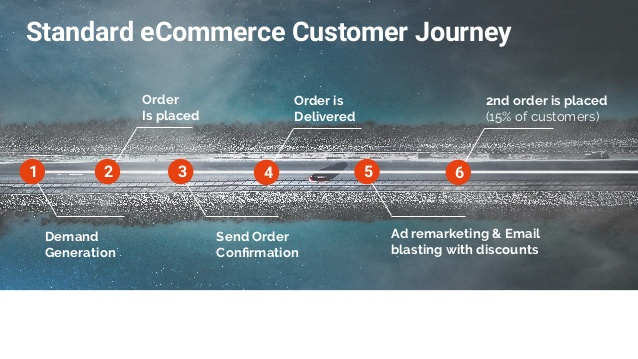

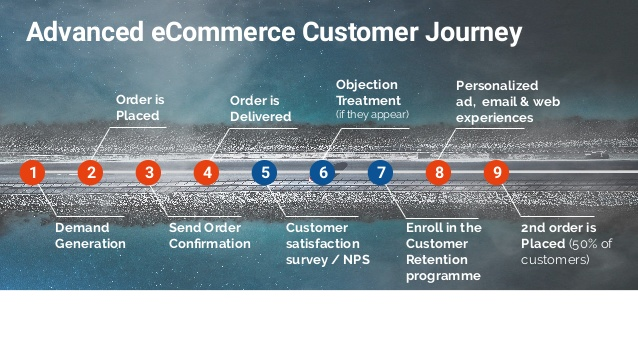

The advanced e-commerce customer journey represents the direct-to-consumer (DTC) push that consumer packaged goods and retail companies have been taking in recent years and, in particular, has been accelerated post COVID.

As COVID progresses and creates the new 21st century norms, five emerging themes are holding true for the companies beating their quarterly estimates by an exponential delta.

#1 – Increased E-Commerce Marketing

Cross channel marketing using a personalized data store (PDS) has become an increasing theme, with marketing teams collaborating more actively to consolidate marketing efforts for more personalized experiences. Instead of single channel goals, email, content, social and display are being measured across the same set of objectives and key results (OKRs) with matrix structure teams enabling this in multinational organizations. Let’s study each channel to understand its true value.

- Email Marketing: According to Campaign Monitor, 68% of emails are opened on smartphones and the average open rate is 22.86%. With consumers on the go and dependent on mobile, emails reduce order cart abandonments by 69%, according to OmniSend.

- Content Marketing: Content marketing has traditionally been the most successful channel to acquire customers in current conditions. Acquiring customers via longer lasting hooks like credit card offers serve to preserve the flywheel effect towards longer lasting interactions with brands. Best in class content pieces include call-to-actions with offers, discounts and early access to events.

- Social and Programmatic Marketing: Social media platforms are developing new ad formats with more variants via triggers related to current market conditions like COVID, weather, seasons and customer data platform (CDP) and data management platform (DMP) based audience data. In fact, cross channel email and contact consumption data can serve as useful triggers to get to the ideal 1:1 customer experience across platforms.

#2 – More Automation

Businesses are being larger with more divisions targeting similar customers, but with very different value propositions. Take Uber: Uber provides ride sharing and on-demand food. If marketed via a single PDS, understanding what the customer would want to see most at the opportune moment is mission critical while maintaining the right level of privacy. Showing a hungry customer an UberXL ad is irrelevant. Within food, showing a customer food items based on their cuisines of interest would yield higher impressions, conversions and repeat interactions. Hence, planning for variants across the business that can dynamically trigger the appropriate messaging, imagery and font is necessary. This is where a healthy understanding of customer experience and campaign differences across markets like the Americas, EMEA and APAC is extremely important.

#3 – Higher ROAS

Purse strings, nowadays, are coming with several strings attached. With easy access to dashboards, analytics and programmable queries, businesses are looking for more consistent demonstration of dollar value over time. This would not just be represented as a steady compound annual growth rate (CAGR) in ROAS, cost per acquisition (CPÅ) and click-through rate (CTR), but a healthy demonstration across a rich set of additional key performance indicators like sales conversion rates, email opt-ins, shopping cart abandonment rate, gross merchandise value per transaction, refund rates, return rates, subscription rates and program participation rates. The combination of these metrics with an 80/20 lens can enable programmatic optimization of ROI.

#4 – Cross Channel Integration

North American businesses are moving towards a digital native experience in rapid fashion. While China and other APAC markets have been strategically digitally native first, American multinational businesses, having been around for a longer time, are thinking transformation before full blown digital nativity. Hence offline to online integration is mission critical. Brick and mortar stores have been rapidly folding in light of COVID with margin first mindsets driving brands towards DTC experiences. Hence, omnichannel experiences like “Buy Online, Return In-Store” (BORIS) and “Buy Online, Pick Up In-Store” (BOPIS) are taken a step further with options like concierge services, curb-side pickups, 24 hour deliveries and Amazon Prime like loyalty programs and benefits.

#5 – Self Service Platforms

Most multinational companies understand the need to embrace technology to scale and save project dollars in the process. While building all technology in-house may not be feasible for all companies, partnering with cutting edge technology platforms definitely is a viable alternative. Centers of excellence are becoming a common theme across different functions, with program leads tasked to work with technology platforms to meet and supersede a handful of intended objectives. Working with best in class platforms with robust technology moats via certifying in-house developers, analysts and project managers on platforms is the future to iteratively and successfully scale.

To understand the tactful implementation of these robust strategies towards an accelerated DTC experience with higher margins, ROAS and customer lifetime values, please connect with us. At Jivox, we have partnered with Fortune 500 companies globally for over a decade to transform their e-commerce marketing and creative advertising efforts. Investing in these globally can enable brands to compete better and faster and / or innovate in their respective geography.