Commerce Media: The Big Shifts Ahead

Trend 1: The Move from Onsite to Offsite Retail Media

This post is the second in a series of posts I am publishing to cover the key trends in the rapidly growing and evolving Commerce Media (fka Retail Media) market.

For many years now when someone mentioned retail media, they mostly were referring to ads run on a retailer’s website or app. Retail media on the whole today is dominated by Amazon, with a whopping 75% market share this year. This has prompted many retailers to explore ways to grow their retail media capabilities despite their significantly lower website traffic than Amazon.

While it is tempting for other retailers to follow in the footsteps of Amazon, what is becoming quite evident is that Amazon is unlike most retailers in that 100% of the customers (if you exclude WholeFoods) purchase their products online. This is almost completely the reverse for most retailers – their customers shop mostly in stores. Despite the dot com boom and the more recent COVID-fuelled growth in eCommerce, the fact remains that online retail purchases constitute only 16% of sales for US retailers. In fact, this was at only 11% prior to COVID, which saw it grow rapidly to 16.5%, before dropping dramatically post-COVID to 14.8%. It has now finally nearly recovered to the peak hit during COVID.

What this means is that retailers hoping to follow in the footsteps of Amazon in growing their onsite retail media are likely to be disappointed and will really never get even close to the scale Amazon retail media has achieved – they simply don’t have enough inventory on their websites. On the other hand, they do in large part have sizable numbers of customers that actually can rival Amazon’s. For example this year Walmart clocked in at 255 million weekly customers with Amazon coming in at 240 million. While this number does drop as you go down the chain of retailers, it is still a sizable number for most retailers.

I have always believed that Commerce Media is really all about data and not really about owned inventory for delivering ads. — Diaz Nesamoney, Founder & CEO, Jivox

What I mean by that is if you compare the amounts of data retailers have on consumers including people who shop in their stores, commerce media starts to look like a very scalable business model for all retailers and not just Amazon.

Retailer Challenges With Onsite Sponsored Listings

Despite its popularity and ease of execution, sponsored listing ads, (the products you see when you search on a retailer website tagged as “sponsored”) which form the bulk of commerce media today, have become quite challenging for all retailers except Amazon. Here’s why:

- Sponsored listing ads are predominantly delivered onsite and so retailers who don’t have much traffic to their websites cannot sell much of it.

- Sponsored listing ads are mostly driven just by search keywords (even on Amazon) and so don’t really leverage the rich store sales data which forms the larger portion of a retailers data.

- Sponsored listing ads only tap into the lowest of lower funnel advertising from brands, but don’t really leverage the opportunity for mid- and upper- funnel ads because those ads require elements of the advertiser’s brand which sponsored listing ads do not allow.

Offsite Retail Media: A New Route To Scale

Offsite commerce media is the answer to many of the above challenges for retailers other than Amazon. In fact, it is also becoming the answer for Amazon to scale beyond the $42bn business it is today – which is why Amazon is pushing their DSP to advertisers, offering formats outside sponsored listing ads like display, video etc.

Offsite commerce media has several advantages over onsite media in general, not the least of which is inventory availability. It also taps into retailer’s data to deliver ads without interrupting or cluttering the shopper experience on the retailer’s site or app. This is especially true for app based commerce media platforms like Instacart, Doordash, Gopuff and others where the mobile app real-estate does not leave much room for many ads.

Thanks to modern advertising technology, offsite commerce media enables retailers to quickly and easily use their store data to personalize their ads on any website or app the ads are delivered on. Modern ad tech (DSPs, SSPs and even walled gardens like Meta and Google) are quite adept at using a retailer’s 1st party data to create “custom audiences” against which the ads can run. Many also offer “look-alike” audiences which use advanced modeling to increase the audience sizes by extrapolating attributes of the retailer customers to other customers.

Offsite commerce media therefore offers almost unlimited scale, more formats like social media, video and CTV that retailers simply don’t have and enable retailers to offer up much richer creative and media formats than just onsite sponsored listing ads can.

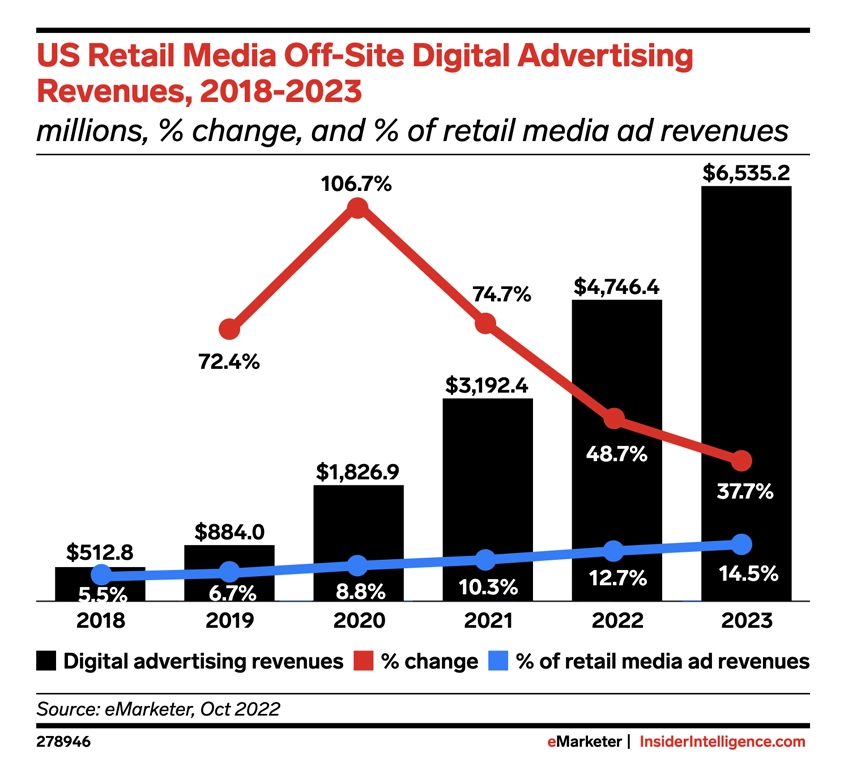

Offsite Retail Media Is Growing, Fast

Currently offsite commerce media is about 16% of retail media but growing at over 30% year-over-year. This is also being accelerated by what I call “non-retail” retail media platforms (hence the term commerce media) like JP Morgan Chase, Intuit, Paypal and Marriott who primarily will deliver ads offsite as they don’t have much by way of retail shoppers visiting their sites.

Offsite retail media also is starting to get the attention of brand marketers as they seek better targeting, with 3rd party cookie deprecation continuing to cause challenges for marketers, as CPG brands often don’t have much by way of their own 1st party data. Offsite retail media enables such marketers to use offsite retail media not only for lower funnel performance marketing, but also for mid- to upper-funnel brand building. The richer formats available offsite like social media, video, CTV and larger display ad formats all provide a richer canvas for marketers to think of retail media as being much more than a performance marketing channel.

Richer formats however means that offsite commerce media ads require another type of automation creative automation. Platforms like Jivox IQ DaVinci enable brands to use retailer pre-approved creative templates to manage their offsite retail media campaigns across multiple RMNs ensuring conformance to their specs whilst using their 1st party audiences and product feeds to personalize ads.

Further, due to the close relationship between CPG brands and retailers, it does help solidify those relationships even further if CPG brands go beyond the “trade” or JBP spending that constitutes the majority of retail media spend to spending branding dollars with their retail partners.

All of this bodes very well for offsite retail media and it may indeed be the only way retailers can have a hope of getting a sizable amount of the growing market for retail media.

Next up I will be talking about how offsite commerce media offers richer canvases to advertise their products. Stay tuned!