The Consumer Packaged Goods industry has seen several shifts in consumer buying patterns over the last decade, seeding new innovation ideas including rising private label brands and value chain innovations. With COVID, this innovation pace has accelerated and shifted towards direct-to-consumer (DTC) strategies in a space previously dependent heavily on brick & mortar wholesale distribution. General Mills reported a 250% growth in e-commerce sales, with this channel accounting for 9% of total sales. CPG giants including Pepsico have responded quickly to this digital shift by launching two food & beverage DTC sites- Snacks.com & PantryShop.com. Such investments are paving the way for CPG brands to uncover growth from digitally native channels.

Here are some key trends shaping the CPG industry:

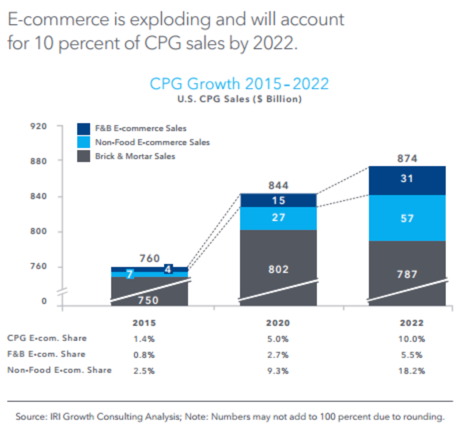

Online Is Preferred To In-Store. In-store experience has helped brands increase awareness for new product introduction, promoting trials, and cross-selling/up-selling. However, with the advent of online shopping, brands have noticed a reduction in the need for the in-store experience. Following physical distancing regulations, consumers have an increased preference for online shopping over in-store shopping as it provides a safe experience. According to IRI, by 2022 e-commerce will contribute 10% to all CPG sales.

Having said that, some categories within CPG have realized a more significant growth in e-commerce sales.

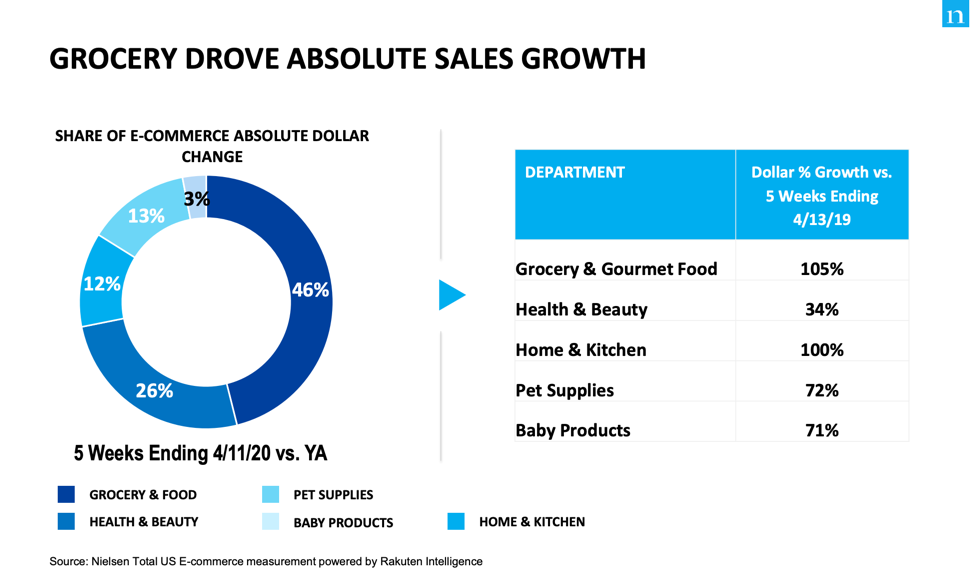

According to a report from FMI citing Nielsen and Rakuten data intelligence, the Grocery category has delivered the most significant relative growth by growing its share of total category sales by 46% YOY, from 4.4% of total category sales in 2019 to 6.4% share of total sales in 2020.

The Need for Unified User Data. With no direct last touch with consumers at the point of sale, brands lack a unified view of consumer journey across marketing and point-of-sale touch points, including last touch purchase data. This is a major handicap for brands as unified user data can eliminate a lot of the guesswork feeding into marketing content and targeting strategy. Marketers utilizing an unified measurement approach are more likely to report growth rates of higher than 10 percent, per the report from The CMO Club.

An Increasing Number of DTC Private CPG Labels. CPG giants across the globe have seen increasing competition from new-age rising DTC private labels who are approaching consumers with a strong sense of brand connection, refined sharper brand stories. According to a report from McKinsey, small & medium brands and private labels contributed 45% and 30% respectively to the total CPG value growth as compared to 25% contribution from leading CPG brands. These new-age private DTC labels are not only innovating the ways in which consumers purchase, including the introduction of subscription models, but also are providing seamless unified omnichannel consumer experience.

E-Commerce and Way Forward

The shift in consumer buying pattern towards online and rising DTC brands have called for a much-needed shift in marketing and distribution strategies, heavily focussing towards e-commerce. The lack of direct touch with consumers makes it difficult for brands to shift towards e-commerce. However, benefits such as lower cost of operations, higher control on consumer brand experience, visibility, and ownership of consumer data have convinced brands to redirect investments in e-commerce-related innovations.

Here are a few strategies that brands can leverage to monetize this change in buying behavior:

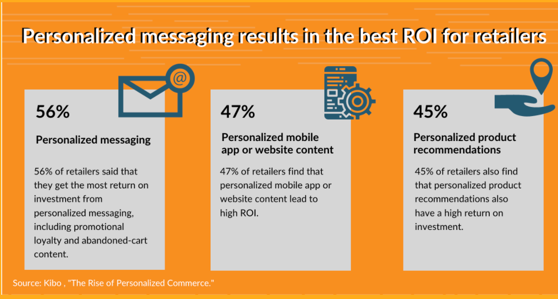

- E-Commerce Marketing Personalization– Brands can leverage AI & ML capabilities to understand user intent based on interaction across several touch points including online and offline POS, feeding into integrated data-driven e-commerce marketing strategy. A surge in available product options across categories can leave a consumer feeling overwhelmed. Personalized communication can help in providing relevant product recommendations to users based on their buying profile and preferences. As a result, leading to increased sales and a strong brand-consumer loyalty base over time.

Source: Personalization is a Top Area of Focus for Retailers Optimizing Conversion, Tabitha Cassidy, July 29, 2020

Brands can use tactics such as shopping guide filters (such as product category, price, color, product benefit), a chatbot (a problem they are trying to solve- looking for hair repair solutions), profile-based preferences (such as skin type, gender, hair type, etc) along with media exposure and engagement to personalize communication and product recommendations.

- Omnichannel Content Delivery– rising digital media consumption across channels calls for consistent communication across channels in a consumer buying journey from awareness, intent, consideration to purchase. Smart data-driven creative content templates can help brands automating creative production by bringing the media insights, real-time data, and creative together.

- Innovative Business Models – Given the repeat purchase behavior in CPG, subscription-based DTC models are disrupting the CPG industry that was heavily focused on Brick & Mortar distribution. Subscription modes are a great tool for building brand loyalty and ensuring recurring revenue by predicting user consumption and personalizing product recommendations based on user intent, profiles/preferences, and past purchase behavior.

- Custom Delivery Options– More than ever, consumers are now preferring delivery options as they are afraid of stepping out. However, there is no one size fits delivery option that works. Retailers such as Walmart have innovated their last-mile strategies to incorporate contactless delivery. These strategies include BOPIS (buy online pick up in-store), BORIS (buy online and return in-store), curbside pickup, same-day delivery.

- Brand Value and Authenticity– These unprecedented times are a testing ground for brands to prove brand value. Consumers, specifically Genz and millennials, are very particular about the brands they associate themselves with and evaluate brand conduct in terms of sustainability and fair practices. Brands communicating authenticity and stronger brand purpose are more likely to have a loyal consumer base and higher ROI.

E-commerce focussed strategies are helping brands throughout the brand value chain by providing a better understanding of consumer segments/behavior, intelligent product innovation and testing, integrated data-driven marketing through personalization, and improving brand loyalty in the long run.