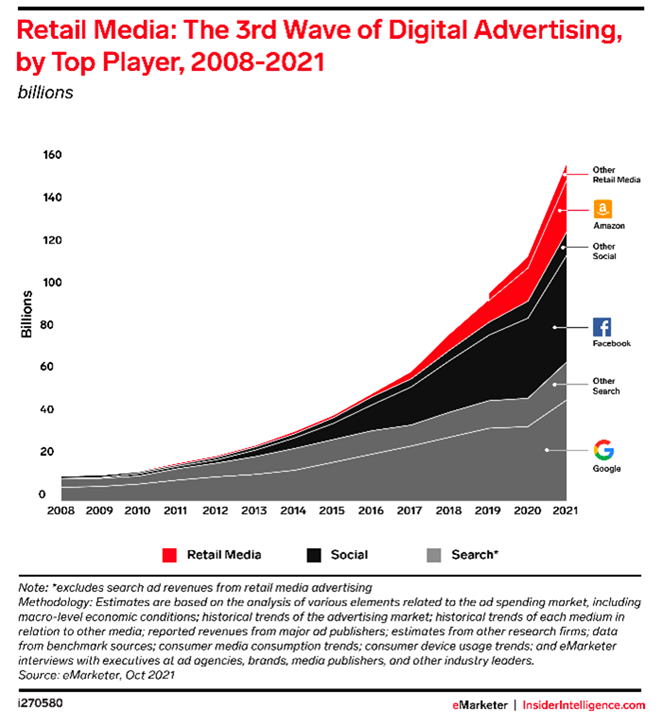

At the Liveramp RampUp event in January 2022, I stood up on stage and shared a slide that made a bold proclamation, which now is turning out to be even bigger than I originally envisioned. My hunch at that time: retail media was not only a powerful new form of media but also had the potential to be much bigger and more important than even search and social media.

At that time, it sounded a bit like heresy to speak about any threat to Google and Facebook’s revenue and their seemingly unstoppable march to take over all of digital media. And yet, I saw several folks taking pictures of my slide and wanting copies of the slide deck. It felt as though a significant change was underway in digital media. Now, we’re all witnessing it.

Fast forward to last week, we saw one of the biggest retail mergers ever announced between Kroger and Albertsons, to create not just an even larger retailer, but a massive retail media network touted to rival the reach of Walmart and Amazon’s retail media businesses.

In between these events, a lot has happened. Meta and Google (Youtube) both reported drops in revenue in Q3 that had never ever happened before. Most of the industry brushed it off as a sign of the start of a recession, and maybe some of it indeed was due to advertising’s pullback, but what many may not know is that at least some of that was caused by a loss of revenue to the growth in retail media. None other than WPP CEO Mark Read said recently, “The [ATT] privacy changes at Apple have clearly had a major impact on advertising spend on some of the social platforms. But that is only part of the story and it has come at the same time as the explosion of TikTok and greater competition more broadly in the digital advertising market – not just from TikTok but also from Amazon, from Uber, from retail media platforms, from Netflix [which launches its ad-supported tier on 3 November].”

There are a lot of reasons to believe retail media may indeed not only be the biggest opportunity ahead for marketers but also the biggest threat to the digital advertising duopoly of Meta and Google. There are several reasons behind the unstoppable growth of retail media, ironically a few caused by Meta and Google themselves, with Apple cheering from the sidelines.

First, right before the start of the pandemic, Google finally announced that third-party cookies would go away. This sent a shockwave through the digital advertising world and created a lot of anxiety not only for publishers but also for advertisers. With many scrambling to find alternatives to cookies, Apple dealt the second blow to the industry by announcing App Tracking Transparency (ATT), which required apps to ask for permission to track the consumer.

Meta, Google and even Apple proceeded to create more secure “walled gardens” of media disallowing any form of external user identification citing privacy issues. Meanwhile they continued to build their stores of so-called first-party data–i.e. data they themselves collected from consumers with consent and offered it to advertisers for advertising on their sites.

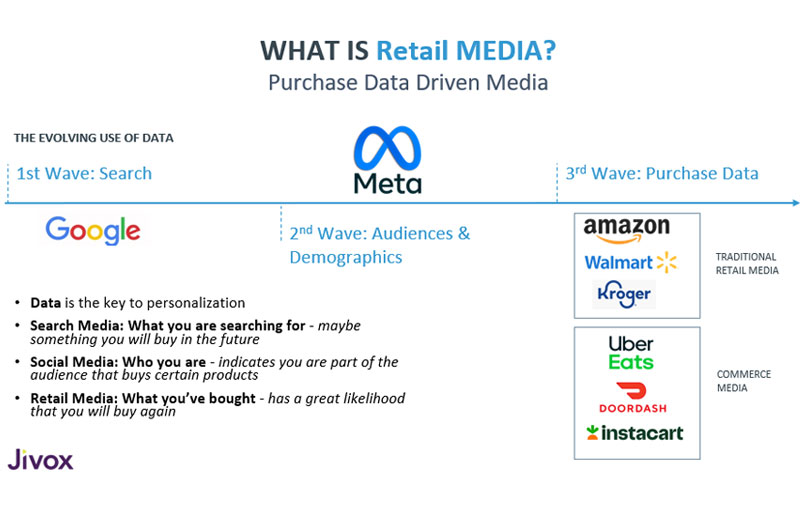

The answer to issues of cookie deprecation and mobile identity loss for many brands is clear – first-party data driven media, not necessarily just what Meta and Google offer but a third form of first-party data driven media initially offered by only Amazon now quickly followed by Walmart, Kroger, Target and other large retailers. As these retailers start to offer media targeting using their consumer purchase data, brands have flocked to buy that media in large numbers – with retail media spend growing from $29bn in 2021 to $40bn in 2022. CPG brands in particular see retail media as the holy grail. After having depended primarily on Meta and Facebook for many years as the primary source of accurate media targeting, retail media offers not only more relevant data –purchase data– that is a much better predictor of future purchase but also real-time signals like search on retailer sites yield arguably better results than Google’s search, which is sometimes not related to purchase intent.

Looking at these numbers, one might still be skeptical about retail media eclipsing social media and search. However, consider this: retailers like Walmart and Target have a significant number of site visitors. Walmart.com now boasts over 140M visitors and Target 65M, which are catching up to Google site visitors of 240M and Meta’s 200M. What will allow retailers to catch up and possibly bypass Google and Meta is that many have now started offering “offsite” media options, i.e. the ability to buy media powered by product purchase data on the open web via programmatic DSPs or by making their data available to so-called marketplaces where media buyers can buy programmatic media powered by retail data.

What makes it even more likely that retail media in aggregate will surpass search and social media is that even non-retailers are jumping into the fray. They range from delivery app companies like Uber and Instacart (both of whom have launched retail media networks) to travel and hospitality companies like Marriott and even Netflix. One could argue that the latter is not retail media but large enterprises that have an abundance of first-party data are definitely considering media offerings. And yes, the term “retail media” is now “commerce media,” which more generally covers any enterprise offering media powered by first-party consented consumer data.

All of these developments demand a new set of technologies to manage all of these retail media options for brands as well as for the retailers themselves. In addition to media buying platforms like The Trade Desk, Microsoft Xandr and Criteo who have created specialized features tailored to allow brands to buy retail media, the technology to power the actual ads running on retail media is also evolving rapidly.

To make the best use of retail media, effective ads need to be more product focused because they are being served to a user with specific product purchase intent. This means they need to feature specific products that they tend to purchase or have searched for, powered by data that the retailer has on their past purchases or recent searches, all provided in a privacy compliant manner. This is why platforms such as the Jivox Commerce Marketing Cloud are essential to ensuring retailers and advertisers can utilize the rich first-party product purchase data, product feeds containing product images and pricing critical to generating Dynamic Product Ads (DPA) across many retail media channels, with rich analytics and attribution tools to ensure these ads are optimized and performing at their best on retail media.

Much like search and social media that drove the revolution in media buying with associated tools and technologies to help brands manage these new formats, retail media will drive the adoption of such new technologies by retailers and advertisers to make the best of this new media format.

While search and social media are definitely not going away anytime soon (witness the growth of Tiktok), retail media will become another powerful option for advertisers. The real losers are likely to be traditional media formats that are non-addressable. As consumers take up more and more personalized content, ads and media surely also must follow as that is what consumers expect from brands.